Types Of Non Life Insurance Policy

Below are the different types of non life insurance and a checklist to determine if you need the following.

Types of non life insurance policy. General insurance is typically defined as any insurance that is not determined to be life insurance it is called property and casualty insurance in the united states and canada and non life insurance in continental europe. Life insurance thus helps you secure your family s financial security even in your absence. Car insurance as the name itself says car insurance insures your car and the riders in the event of accidents resulting from both natural e g. You either make a lump sum payment while purchasing a life insurance policy or make periodic payments to the insurer.

5 unnecessary insurance policies. Life insurance is not a personal contract. These types of policies are more common in european countries. Some life insurance policies even offer financial compensation after retirement or a certain period of time.

Life insurance for kids. Children have no income. There s lots of insurance you might not need such as. The policy offers payment to the policyholder based on the loss incurred from a specific financial event.

These are known as. But when life insurance is not the subject matter of such type of insurance it should not be called non life insurance. Non life insurance products include property or casualty health insurance or house fire marine insurance etc. Endowment plan endowment plans are life insurance policies where a portion of your premiums go toward the.

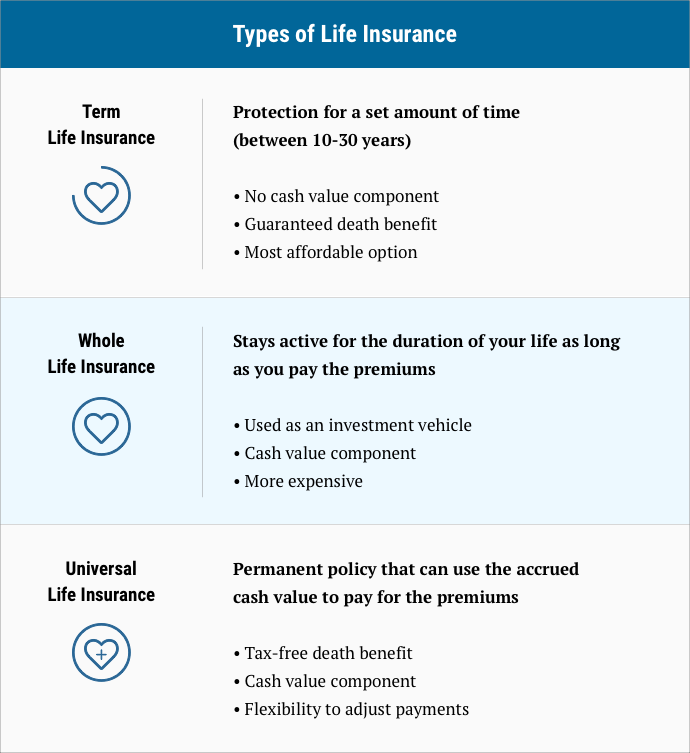

Flying is one of the safest modes of travel. The word general insurance appears to be a right term to understand the concept of such type of insurance activities. Types of life insurance policies. Term plan the death benefit from a term plan is only available for a specified period for instance 40 years from the date of policy purchase.

There are primarily seven different types of insurance policies when it comes to life insurance. Many people will need several types of non insurance from car insurance and health insurance to homeowners insurance and disaster insurance. Common forms of general insurance in india are automobiles mediclaim homeowner s insurance marine travel and others. Theft exterior and interior damages occurrences.

Insurance premiums such as those that cover someone s life home or car do carry some risk for the consumer. Typhoons floods etc and man made e g. Non life insurance also called property and casualty insurance is a type of coverage that is considered personal insurance. According to investopedia the most important types of insurance to have are.

A general insurance policy is a non life insurance product that includes a range of general insurance policies. Life insurance exists to replace lost income.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)